New Update Form 941

Human Resources

STA2023112

90 Minutes

Friday, August 4, 2023

- Saturday, September 30, 2023

Description

Overview

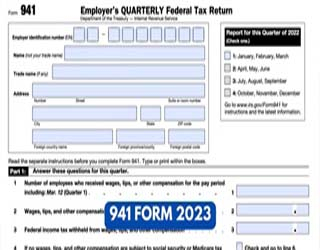

This webinar covers the IRS Form 941 and its accompanying Form Schedule B for 1st Quarter of 2023. It discusses what is new for the latest version form including all changes recently made by the Consolidated Appropriations Act as well as the requirements for completing each form line by line. It includes the filing requirements and tips on reconciling and balancing the two forms. The webinar also covers the forms used to amend or correct the returns.

Form 941 is the link between your payroll records and the IRS tax records. Proper administration of this vital form is critical if you want to avoid IRS Notices and the penalties and interest that accompany them. The Schedule B is also a crucial form for many employers. The IRS demands that the Form 941 and the Schedule B match to the penny…every single time…without fail!

It has always been a requirement that the Forms 941 be reconciled with the Forms W-2 prior to submitting each form. If the employer fails in this reconciliation, the IRS and Social Security Administration can both assess penalties! This reconciliation has become even more critical these past few years.

Learning Objectives:

- For the attendee to understand the requirements for completing the 2023 Form 941 correctly line by line.

- To ensure that the attendee has the basic knowledge to complete the Form Schedule B according to the IRS regulations and to ensure that it reconciles down to the penny with the Form 941 prior to submission.

- To ensure the attendee knows when a Form 941-X is required and provide the attendee with the basic knowledge of how to complete Form 941-X.

- To demonstrate to the attendee the reconciliations needed under IRS and Social Security Administration regulations.

This Presentation will cover:

- Line by line review of the 2023 Form 941

- Tips for completing the Schedule B—liability dates vs. deposit dates

- Tips to balance Form 941 and Schedule B to the penny—as required by the IRS

- Form due dates

- Who should sign the Form 941

- Reporting third party sick pay, group term life insurance and tips correctly

- How to reconcile the Forms 941 with the Forms W-2

- What to do if you discover an error in deposits for the quarter when completing the Form 941

- Using the 941X form to correct the Form 941

Who will Benefit:

- Payroll Executives/Managers/Administrators/Professionals/Practitioners/Entry Level Personnel

- Human Resources Executives/Managers/Administrators

- Accounting Personnel

- Business Owners/Executive Officers/Operations and Departmental Managers

- Lawmakers

- Attorneys/Legal Professionals

- Any individual or entity that must deal with the complexities and requirements of Payroll compliance issues

Table of Contents

- Introduction

- Our Focus For Today 00:00:59

- Overview Of Requirements For Filing And Changes 00:04:12

- Legislation 00:04:18

- Worksheets 00:06:07

- Worksheet 1 - Credit For Qualified Sick and Family Leave Wages Paid in 2021 Before April 1, 2021 00:06:36

- Worksheet 2 - Credit For Qualified Sick and Family Leave Wages Paid in 2021 Before October 1, 2012 00:06:45

- Form 941 For 2023 - Part 1 00:06:48

- Form 941 For 2023 - Parts 1 and 2 00:07:49

- Form 941 For 2023 - Parts 3, 4, and 5 00:08:03

- Purpose of Form 941 00:08:07

- Who Should Complete The Form 00:08:47

- Where And When To File 00:09:21

- Line By Line Review 00:11:58

- Form 941 SS & PR for 2023 00:12:04

- Top of Form 00:15:30

- Part 1 Lines 1, 2, 3 & 4 00:16:46

- Lines 5 a-e: Calculating FICA 00:21:17

- Line 5a: Taxable Social Security Wages 00:21:57

- Line 5a(i): Qualified Sick Leave Wages - 00:26:25

- Line 5a(ii): Qualified Family Leave Wages 00:26:51

- Line 5b: Taxable Social Security Tips 00:27:05

- Line 5c: Taxable Medicare and Tips 00:28:00

- Line 5d: Taxable Wages and Tips Subject to Additional Medicare Tax Withholding 00:28:33

- Line 5e: Total Social Security and Medicare Taxes 00:28:52

- Line 5f 00:29:14

- Line 6: Total Taxes Before Adjustments - No Change 00:32:49

- Lines 7-10 00:33:12

- Line 11a-11g - Nonrefundable Credits 00:42:13

- Line 11a- 00:43:04

- Line 11b 00:44:13

- Line 11c 00:44:57

- Line 11d 00:44:59

- Line 11e & 11f 00:45:22

- Line 11g 00:45:29

- Line 12 - Total Taxes 00:45:36

- Lines 13a-i 00:46:47

- Line 13a - Total Deposits 00:46:59

- Line 13b -Reserved For Future Use 00:47:36

- Line 13c - Refundable Credit 00:47:39

- Line 13d - Reserved For Future Use 00:48:07

- Line 13e - Refundable Credits 00:48:13

- Line 13f - Line 13f Reserved 00:49:26

- Line 13g - Total Deposits and Refundable Credits 00:49:30

- Line 13h & 13i Reserved for Future Use 00:49:54

- Line 14 & 15: No Change 00:49:58

- Line 16: No Change 00:55:39

- Lines 17 and 18 00:57:53

- Lines 19 -28 00:58:24

- Lines 19 - Health Plan 00:58:53

- Line 20 - Health Plans 00:59:11

- Line 21 and 22 00:59:22

- Line 23 00:59:26

- Line 24 00:59:36

- Line 25 00:59:49

- Line 26 01:00:29

- Line 27 01:00:38

- Line 28 01:01:22

- Part 4 Third Party Designee 01:01:34

- Part 5 Sign Here 01:004:04

- Worksheet 1 - Final Review 01:05:17

- Worksheet 1 - Credit For Qualified Sick and Family Leave Wages Paid in 2022 Before April 1, 2021 01:05:20

- Worksheet 2 - Final Review 01:007:26

- Worksheet 2 - Credit For Qualified Sick and Family Leave Wages Paid in 2022 Before October 1, 2021 01:07:29

- Schedule B and Line 16 01:07:42

- Schedule B 01:07:42

- Schedule B (and Line 16) 01:12:12

- Form 941-X 01:12:50

- Form 941-X Example 01:14:00

- Overall Changes to the 2022 Form 01:15:03

- Overall Changes to the 2022 Form Cont’d 01:15:19

- Completing the Form 01:15:38

- Part 1 01:17:58

- Part 2 01:18:46

- Part 3 01:21:49

- Part 3 Cont’d 01:24:06

- Part 4 01:24:58

- Part 5 01:25:57

- Questions 01:36:50

- Presentation Closing 01:49:55

Index

- Audit 00:31:02

- COBRA 01:15:22

- COVID-19 00:21:33, 00:33:09, 00:44:26, 00:58:30

- EIN 00:16:22

- Employee Retention Credit 01:15:24

- Federal Insurance Contributions Act (FICA) 00:08:37, 00:21:26, 00:31:20, 00:34:19, 00:41:06, 01:06:35

- Form 8974 00:43:12

- Form 941 00:01:21, 00:06:45, 00:09:02, 00:15:37, 00:37:44, 00:49:45, 01:01:46, 01:21:41, 01:31:08

- Form 941-PR 00:12:30

- Form 941-SS 00:12:28

- Form 941-X 00:03:28, 00:07:58, 00:48:04, 01:13:35, 01:17:13, 01:34:01

- Form W-2 00:18:16, 01:27:59

- Liability 00:51:25, 01:09:27

- Non-Refundable Credit 00:42:37, 00:46:26, 01:09:14

- Refundable Credit 00:43:25, 00:44:44, 00:46:47, 00:48:20

- Schedule B 00:33:59, 00:36:25, 00:56:23, 01:07:42, 01:12:16, 01:28:10

- Section 3121(q) 00:31:13

- Wage 00:07:05, 00:17:47, 00:22:00, 01:28:59

Key Terms

COBRA: The Consolidated Omnibus Budget Reconciliation Act (COBRA) gives workers and their families who lose their health benefits the right to choose to continue group health benefits provided by their group health plan for limited periods of time under certain circumstances such as voluntary or involuntary job loss

COVID-19: COVID-19 (coronavirus) is an illness caused by a virus that can spread from person to person. The virus that causes COVID–19 is a new coronavirus that has spread throughout the world. COVID-19 symptoms can range from mild (or no symptoms) to severe.

EIN: The Employer Identification Number, also known as the Federal Employer Identification Number or the Federal Tax Identification Number, is a unique nine-digit number assigned by the Internal Revenue Service to business entities operating in the United States for the purposes of identification.

Employee Retention Credit: The Employee Retention Credit is a refundable tax credit against certain employment taxes equal to 50 percent of the qualified wages an eligible employer pays to employees after March 12, 2020, and before January 1, 2021.

Federal Insurance Contributions Act (FICA): The Federal Insurance Contributions Act is a United States federal payroll contribution directed towards both employees and employers to fund Social Security and Medicare—federal programs that provide benefits for retirees, people with disabilities, and children of deceased workers.

Form 7200: The IRS has issued Form 7200 to allow qualifying employers to file in advance to receive the refundable tax credits for qualified sick and family leave and the employee retention tax credit.

Form 941: Federal form 941, also called a quarterly federal tax return, is an IRS return that employers use to report their FICA taxes paid and owed for the period. The IRS uses this form to calculate the amount of employer tax payments made during the year as well as the amount of taxes due at the end of the year.

Form 941-PR: Employers in Puerto Rico use this form to: Report income taxes, social security tax, or Medicare tax withheld from employee's paychecks. Pay the Employer's portion of social security or Medicare tax.

Form 941-SS: Use Form 941-SS to report social security and Medicare taxes for workers in American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands.

Form 941-X: Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund.

Form W-2: Form W-2 is an Internal Revenue Service tax form used in the United States to report wages paid to employees and the taxes withheld from them. Employers must complete a Form W-2 for each employee to whom they pay a salary, wage, or other compensation as part of the employment relationship. - Wikipedia (https://en.wikipedia.org/)

Liability: In financial accounting, a liability is defined as the future sacrifices of economic benefits that the entity is obliged to make to other entities as a result of past transactions or other past events, the settlement of which may result in the transfer or use of assets, provision of services or other yielding of economic benefits in the future.

Non-Refundable Credit: A non-refundable tax credit is a tax credit that can only reduce a taxpayer's liability to zero. 1? Any amount that remains from the credit is automatically forfeited by the taxpayer. A nonrefundable credit can also be referred to as a wastable tax credit, which may be contrasted with refundable tax credits.

Refundable Credit : Refundable tax credits are called “refundable” because if you qualify for a refundable credit and the amount of the credit is larger than the tax you owe, you will receive a refund for the difference. For example, if you owe $800 in taxes and qualify for a $1,000 refundable credit, you would receive a $200 refund.

Schedule B: The IRS uses Schedule B to determine if you've deposited your federal employment tax liabilities on time. If you're a semiweekly schedule depositor and you don't properly complete and file your Schedule B with Form 941, the IRS may propose an “averaged” FTD penalty

Section 3121(q): Under section 3121(q) of the Code, for purposes ofthe employee share of FICA taxes imposed by sections 3101(a) and (b), tips that areproperly reported to the employer pursuant to section 6053(a) are deemed to be paid atthe time a written statement is furnished to the employer pursuant to section 6053(a).Unreported tips received by the employee are deemed to be paid to the employee whenactually received by the employee.

Wage: A fixed regular payment, typically paid on a daily or weekly basis, made by an employer to an employee, especially to a manual or unskilled worker.

Speaker

Vicki M. Lambert

Vicki M. Lambert, CPP, is President and Academic Director of The Payroll Advisor™, a firm specializing in payroll education and training. The company (www.thepayrolladvisor.com) offers a payroll news service which keeps payroll professionals up-to-date on the latest rules and regulations.

With nearly 40 years of hands-on experience in all facets of payroll functions as well as over three decades as a trainer and author, Ms. Lambert has become the most sought-after and respected voice in the practice and management of payroll issues. She has conducted open market training seminars on payroll issues across the United States that have been attended by executives and professionals from some of the most prestigious firms in business today.

A pioneer in electronic and online education, Ms. Lambert produces and presents payroll related audio seminars, webinars and webcasts for clients, APA chapters and business groups throughout the country. Ms. Lambert is an adjunct faculty member at Brandman University in Southern California and is the creator of and instructor for their Practical Payroll Online program, which is approved for recertification hours by the APA. She is also the instructor for the American Payroll Association’s “PayTrain” online program also offered by Brandman University.